As we step into 2024, the renowned Swiss watchmaker Rolex has made headlines with its recent price adjustments. While the luxury watch market is accustomed to periodic price revisions, the specifics of this year’s changes are particularly noteworthy. With a 5-10% price increase in various regions excluding Switzerland and the USA, Rolex’s strategy reflects a complex interplay of market dynamics and economic factors. This article delves into the details of these adjustments and their implications for both consumers and the luxury watch industry.

Global Price Increases

In Europe (excluding Switzerland), Canada, Taiwan, India, and Australia, Rolex prices have witnessed an approximate rise of 5-10%. This decision seems aligned with global economic trends, particularly with inflation rates and currency value fluctuations. Contrary to popular belief, Rolex’s pricing strategy is not about annual increments but aligning with economic realities. This approach is evident from their pricing history; notably, from 2012 until early 2020, there were no price increases for Rolex watches in the USA.

Stability in Switzerland and the USA

Interestingly, 2024 did not bring any price changes in Switzerland, the home of Rolex, and the United States. This stability could be attributed to a variety of factors, including market strength, currency stability, and strategic brand positioning in these key markets. It underscores Rolex’s nuanced approach to pricing, taking into account regional economic conditions rather than a blanket global increase.

Focus on Steel and Two-tone Models

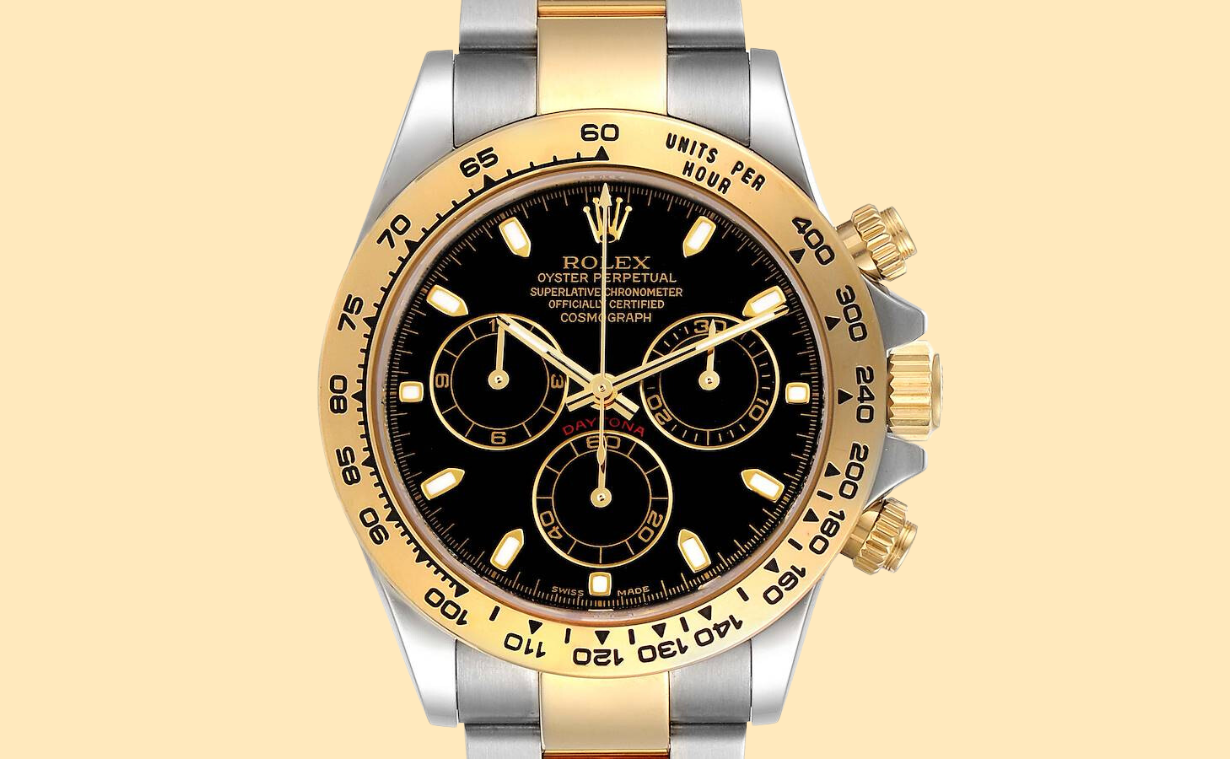

A remarkable aspect of this year’s price revision is the focus on steel and two-tone models, which have seen the most significant percentage increase compared to precious metal models. This shift could be interpreted as a response to the growing demand for these models, often celebrated for their durability and aesthetic appeal. The higher demand for steel and two-tone watches has likely influenced their higher price increment.

Economic Rationale Behind Price Increases

While some view these price increases as mere business strategy, it’s essential to understand the economic rationale behind them. Rolex, like many other global entities, adjusts prices to stay in line with inflation and currency valuations. These adjustments ensure that the brand maintains its market position and financial health across various economies.

Impact on Consumers and the Secondary Market

For consumers, these price changes might affect purchasing decisions, particularly in regions with significant increases. It may also invigorate the secondary market, where price discrepancies can create opportunities for both buyers and sellers. Collectors and investors might find this a favorable time to reassess their collections in light of the new price landscape.

Rolex’s 2024 price adjustments are a reflection of their strategic approach to global market dynamics. While these changes vary across regions, they are a testament to the brand’s understanding of economic trends and consumer behavior. As the year progresses, it will be interesting to observe how these adjustments play out in the global luxury watch market, influencing both current trends and future strategies.